Ga 529 Contribution Deadline 2025. 529 contribution limits for 2025: Although these may seem like high caps, the limits apply to every type of 529 plan account you open per child.

If a taxpayer contributes to a georgia 529 college savings plan, a portion of the contribution can be. What’s the contribution limit for 529 plans in 2025?

2025 529 Contribution Limits Your Complete Guide to Maximum, For security, and based on the data you provided in your. But while there’s no federal.

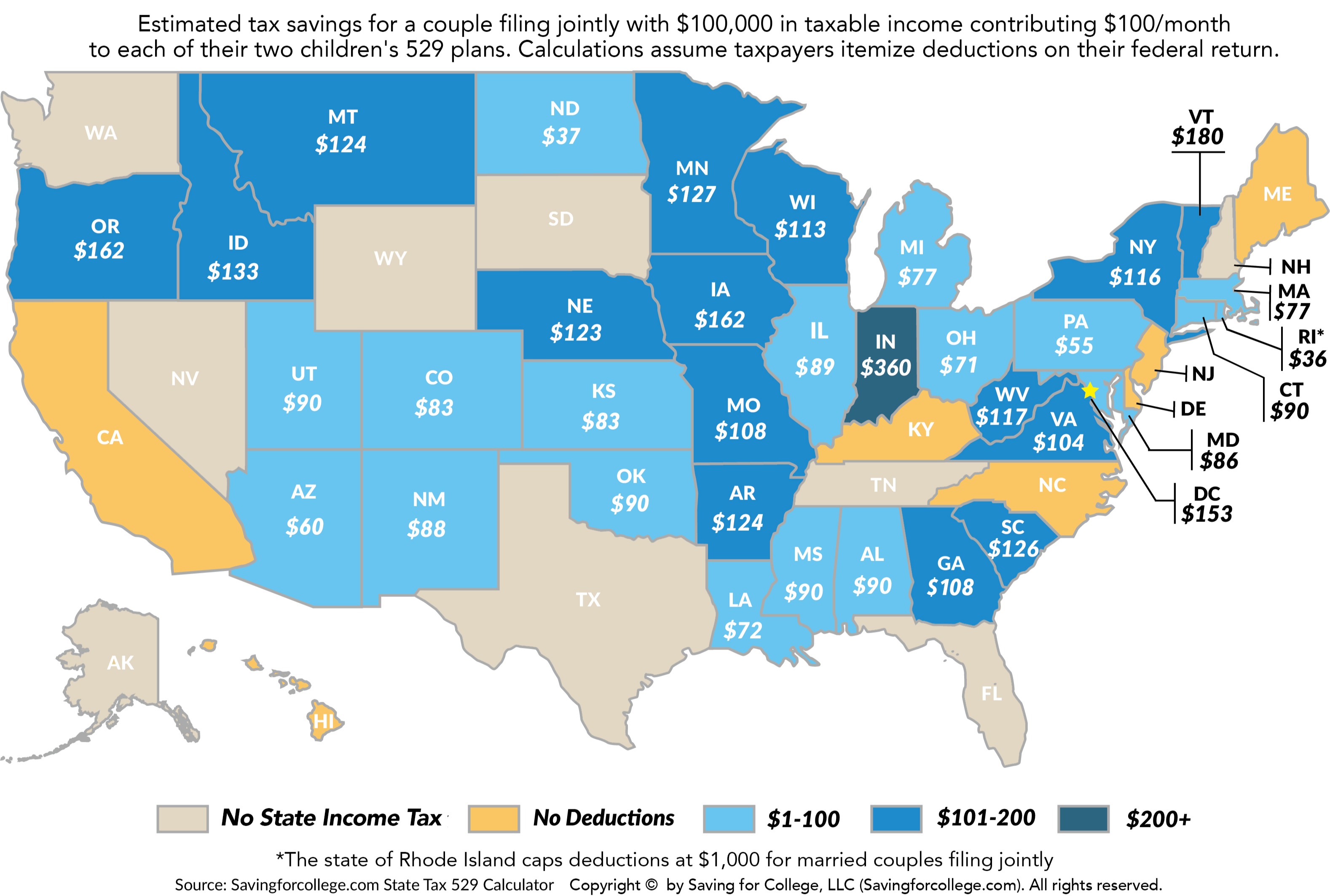

2025 529 Contribution Limits What You Should Know MyBikeScan, Georgia’s 529 plan was established in 2002 and allows georgia tax filers to deduct up to $8,000 per year, per beneficiary if filing mjf, $4,000 for all other. Georgia offers a state tax deduction for contributions to a 529 plan of up to $4,000 for single filers and $8,000 for married filing jointly tax filers.

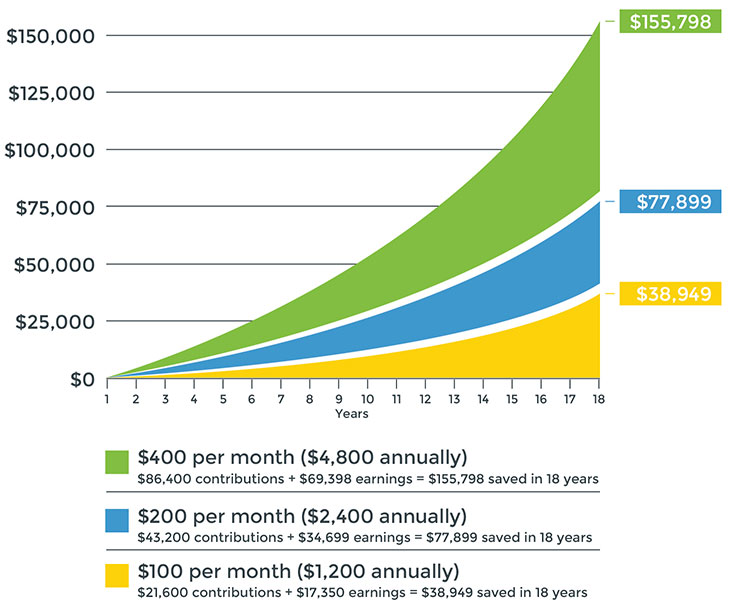

Max 529 Contribution Limits for 2025 What You Should Contribute, But while there’s no federal. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

7 Things to Consider Before Starting a 529 Plan, Our records indicate that this is the first time your gacollege411 account is being used on gafutures. Your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1.

529 Plan Contributions NEST 529 College Savings, Saving for college provides tax benefits to georgia families. Residents wrestling with the use of the georgia section 529 plan versus other college savings vehicles need to factor in the potential savings of this state income tax.

529 Plan Contribution Limits For 2025 And 2025, What’s the contribution limit for 529 plans in 2025? One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

How Much Is Your State's 529 Plan Tax Deduction Really Worth?, What’s the contribution limit for 529 plans in 2025? One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

529 Plan Contribution Limits Rise In 2025 YouTube, How much you can contribute to a 529 plan in 2025. Ga 529 plan tax deduction:

Beginner's Guide to 529 College Savings Plan Dad MBA, The table below illustrates the current 529 plan contribution maximums by state: For security, and based on the data you provided in your.

Irs 529 Contribution Limits 2025 Rory Walliw, Ga 529 plan tax deduction: For contributions made to a path2college 529 plan account by april 15, 2025, georgia taxpayers may be eligible for a 2025 state income tax deduction up to.

529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary.

For contributions made to a path2college 529 plan account by april 18, 2025, georgia taxpayers may be eligible for a state income tax deduction up to $8,000.